Happy Friday, friends 👋

Fresh off the Grok 4 launch, Elon Musk’s AI outfit, xAI, is reportedly in talks to lease data‑centre capacity in the Kingdom, scouting energy‑rich regions with the capital depth and geopolitical alignment to feed its ever‑growing compute appetite. Two contenders have surfaced so far: the newly launched sovereign AI giant HUMAIN and an as‑yet‑unnamed player. Compute really is the new oil.

Over in the Valley, the AI talent wars show no sign of slowing. While most eyes were glued to the Windsurf fiasco, one move that caught our attention was Meta’s acquisition of Play.ai, a voice‑AI start‑up founded in 2020 by Egyptian ex‑Dubizzle engineer Mahmoud Felfel.

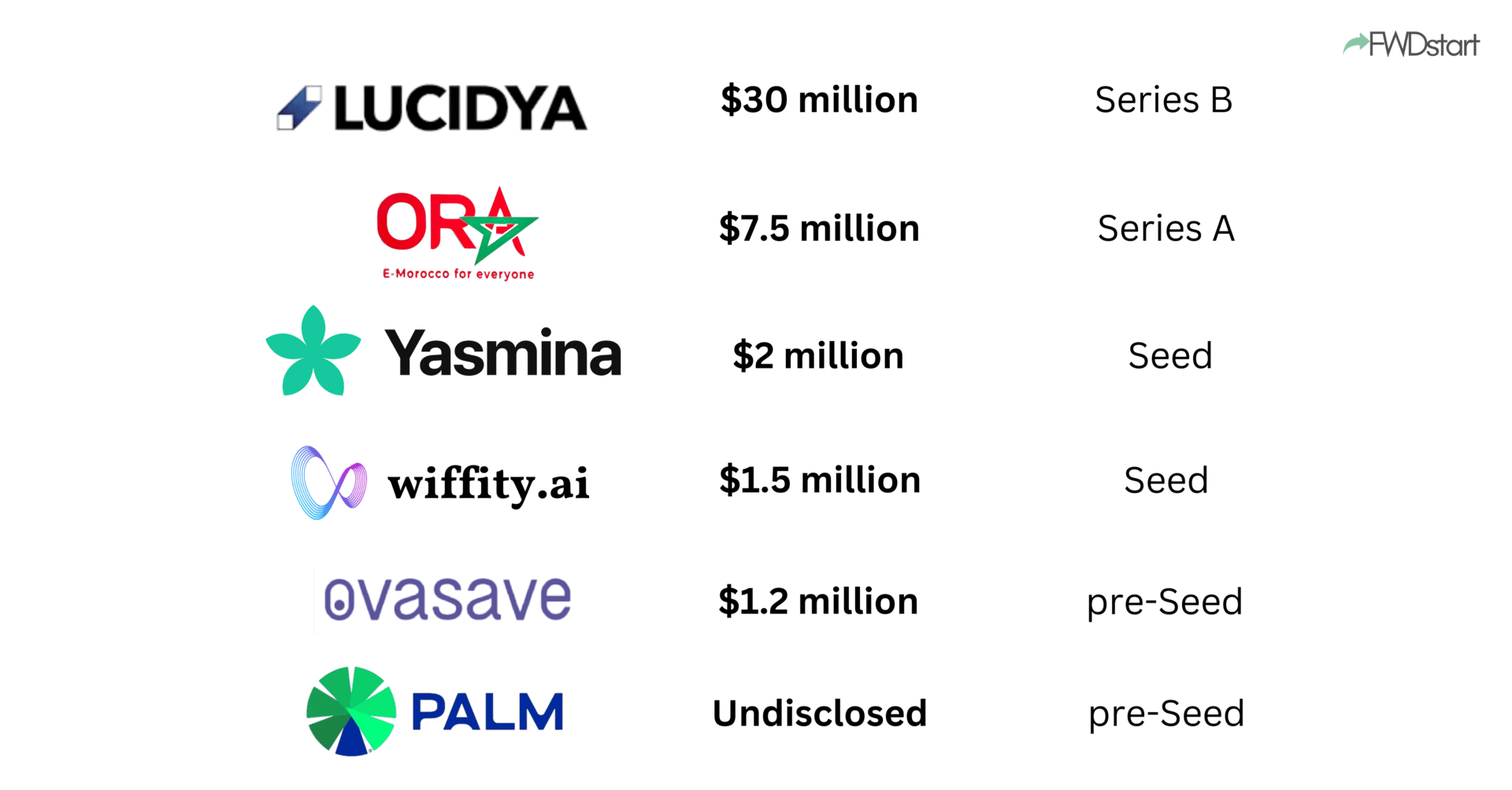

On the regional funding front, Lucidya landed a $30 million Series B led by Impact46 to expand its Arabic‑language AI and workforce platform. In Morocco, ORA Technologies secured a $7.5 million Series A to press ahead with its super‑app ambitions, and Riyadh’s embedded‑insurance player Yasmina closed a $2 million seed round.

We spoke with Yasmina’s co‑founder and CEO Masoud Alhelou a couple of weeks back about the size of the regional embedded‑insurance opportunity, regulatory hurdles, and why it could be fintech’s next big unlock.

On the VC front, Cairo‑based A15 marked its tenth anniversary by revealing that Fund I has already returned more than 10× DPI to LPs, powered by two dragon exits.

Finally, don’t miss our latest deep dive: we unpacked Tabby’s Q1 2025 numbers; profit surge, credit‑loss drag, breakneck revenue growth, and the leverage‑heavy funding stack behind the Middle East’s most valuable VC‑backed fintech. Catch the full analysis here.

Now, let’s get into this week’s edition👇

This week’s round-up is a 5 min read:

🚀 Startup funding round-up

Lucidya (🇸🇦 KSA), an Arabic-first AI platform for customer experience management (CXM), has raised $30 million in Series B funding led by Impact46, with participation from Wa’ed Ventures, Takamol Ventures, SparkLabs, Rua Growth Fund, and ARG, to scale its AI Agent suite and expand across telecom, BFSI, healthcare, and public sectors in 11 countries.

ORA Technologies (🇲🇦 Morocco), a super-app combining payments, e-commerce, and on-demand services, has raised $7.5 million in Series A funding led by Azur Innovation Fund and three strategic investors, bringing total local funding to $11.9 million to scale last-mile infrastructure, grow its digital wallet ORA Cash, and digitise Morocco’s cash-heavy commerce sector.

Yasmina (🇸🇦 KSA), an embedded insurance platform integrating protection products into digital journeys via a single API, has raised $2 million in Seed funding co-led by Scene Holding and Access Bridge Ventures, with participation from Arzan VC and the Sanabil Investment Accelerator by 500 MENA, to expand into the UAE and Egypt and scale its infrastructure-first model across sectors like HR, auto, real estate, and point-of-sale.

Wittify.ai (🇸🇦 KSA), a conversational AI startup building Arabic-first voice and text agents, has raised $1.5 million in pre-Seed funding from prominent Saudi angel investors to develop proprietary ASR and TTS engines across 25+ dialects, expand regionally, and scale its no-code platform for enterprise customer automation.

Ovasave (🇦🇪 UAE), a femtech startup backed by Hub71 and focused on fertility, hormone health, and menopause care, has raised $1.2 million in pre-Seed funding led by PlusVC, Annex Investments, and 25 Madison, with participation from UAE and Saudi angels and family offices, to expand across the Gulf and launch new app features including cycle tracking, AI-driven care, and support for perimenopause and menopause.

PALM (🇪🇬 Egypt), a fintech platform enabling goal-based savings and smart investment allocation, has raised a seven-figure USD pre-Seed round led by 4DX Ventures, with participation from Plus VC and international angels, to scale user growth, expand its merchant network, and build culturally resonant financial tools across Egypt and the Mediterranean.

Catch up on recent deep-dives

Exclusive interview

Building the GCC's first embedded insurance platform

In Saudi Arabia, most insurance still happens offline. Masoud Alhelou, who once grew Expedia’s travel-insurance arm from scratch, set out to change that with Yasmina, an API that lets platforms like Jisr and Syarah bundle coverage directly into checkout flows.

The startup just raised $2 million (Scene Holding, Access Bridge Ventures, Arzan VC, Sanabil/500 MENA) and will enter the UAE this year, Egypt in 2026. Yasmina claims partners can go live in under 48 hours and, within five years, hopes to become the region’s first fully digital insurer.

I had the chance to sit down with Masoud a couple of weeks back. We unpacked Yasmina’s regulatory moat, their zero-CAC distribution playbook, and why embedded insurance may be MENA’s next big fintech unlock.

💸 VC

The A15 team

🇪🇬 Cairo-based venture firm A15 has returned more than 10x DPI to LPs from its first fund, joining a small group of global VCs to hit that threshold. The firm didn’t disclose fund size or exact returns, but noted that two portfolio companies, TPAY Mobile (acquired by Helios) and Connect Ads (acquired by Aleph Group), each returned the full fund. A15 has exited eight companies in total, including Link Development’s recent acquisition by Beyon Solutions. Founded in 2015, the firm has built a 40-company portfolio across nearly 20 MENA markets and is known for its hands-on operational approach, from hiring and GTM to governance and expansion.

🇸🇦 Sukna Capital has launched the Sukna Fund for Direct Financing (SFDF), becoming the first non-bank lender in Saudi Arabia to receive Capital Market Authority clearance for an open-ended, Sharia-compliant direct lending vehicle. The evergreen structure allows institutional investors to subscribe or redeem at periodic intervals, while offering founders non-dilutive, asset-backed capital matched to cash-flow cycles. Sukna recently deployed a $20 million facility to UAE-based fintech OCTA, demonstrating its thesis of embedding working-capital credit directly into software used by SMEs.

🤖 AI

🧠 Elon Musk’s xAI is in early talks to lease data centre capacity in Saudi Arabia, exploring infrastructure deals to support its expanding compute needs. One option involves HUMAIN, a Saudi AI startup backed by the Public Investment Fund, which has offered multi-gigawatt capacity, though the project remains years away from completion. A second, more immediate prospect is a 200-megawatt facility currently under construction by another unnamed firm. The move aligns with Musk’s push to secure cheap energy and friendly jurisdictions for AI development, as geopolitical tensions in the US grow. xAI is also in contact with UAE-based G42 and exploring additional sites in Africa. The discussions follow xAI’s recent $10 billion fundraise.

🤝 Acquisitions

🤖 Tactful AI, the Egypt-born customer experience (CX) platform, has been reacquired by its original founders Mohamed El-Masry and Mohammed Hassan, marking a strategic separation from Belgian firm Dstny, which acquired it in 2022. The move signals a renewed focus on regional and global growth, with expansion plans across Saudi Arabia, the UAE, and Western Europe. Tactful AI, which helps enterprises manage 100% of digital interactions in real time, positions itself as a regional alternative to global CX tools like Zendesk and Intercom.

💸 IHC Investment Group has acquired UAE-based SME financing platform eFunder and relaunched it as Zelo, aiming to expand access to invoice-based financing across the region. Operating under ADGM’s FSRA, Zelo offers receivables-backed loans through a fully digital process, addressing the $250 billion SME funding gap in MENA and supporting faster cash flow for businesses facing long payment cycles.

🏢 Blue Five Reef Private Equity Fund, which recently raised $2 billion to back late-stage Gulf companies, has made its first major acquisition with Wasoom Holding, a UAE-based conglomerate with interests across agriculture, aviation, healthcare, tech, real estate, and hospitality. The deal aligns with Blue Five’s strategy to build regional champions through operational upgrades, tech enablement, and cross-sector integration.

📈 Public Markets

📈 Saudi Arabia is opening up the Tadawul Stock Exchange to GCC residents, allowing them to invest directly in listed equities for the first time. Previously restricted to swap agreements or the parallel Nomu market, GCC investors can now access the kingdom’s main bourse, while ex-residents will retain investment rights. The CMA says the reform aligns with Vision 2030 goals to deepen capital markets and attract foreign investment amid broader liberalisation efforts, including new property ownership laws and IPO market expansion.

🌍 International investments

The PlayAI team

📢 Meta has acquired PlayAI, a California-based voice AI startup known for Play Dialog, its multi-turn speech model trained on hundreds of millions of conversations. Financial terms were not disclosed. Founded in 2020 by Egyptian engineer Mahmoud Felfel and Hammad Syed (both ex-Dubizzle engineers), PlayAI has also developed a no-code voice-agent builder, multilingual TTS models, and Playnote – a custom voice interface likened to “NotebookLM with any voice.” The startup recently raised a $21M seed round led by Kindred Ventures and 500 Global, with participation from Y Combinator, Race Capital, Soma Capital, and others.

🔐 Golden Gate Ventures’ MENA Fund has backed SpeQtral, a quantum tech company developing next-generation quantum key distribution (QKD) infrastructure. SpeQtral enables secure quantum communication networks for governments and enterprises, protecting sensitive data in a post-quantum world. This marks the fund’s fifth investment to date.

🚪 New Entrants

HaloTech CEO and Founder Manu Marín

🦺 HaloTech, a Spanish startup using AI and IoT to prevent workplace accidents, has raised $11.7 million to scale its platform and expand globally across the US, LATAM, the Middle East, and EMEA. Founded in 2023, the company offers real-time environmental and behavioural risk monitoring through its HaloTech AI system, with plans to open factories in Texas, São Paulo, and Spain to support its “Safety as a Service” rollout.

💧Water Harvesting Inc. (WaHa), a U.S.-based water-from-air technology company, has raised $8 million in Series A-1 funding to restructure ownership, repay debt, and expand commercially across the Gulf. With field trials underway at Khalifa University and deployments already in Abu Dhabi and Riyadh, WaHa plans to unveil its first commercial Vaporator unit at WETEX Dubai in September 2025.

📷 TASS Vision, an Uzbekistan-based AI startup specialising in on-device retail analytics, has raised $1.5 million in funding led by Purple Ventures, with participation from six regional investors including Domino VC and IT Park VC. Founded in 2021, the company is expanding into MENA and Central Eurasia while developing next-gen AI camera hardware that tracks in-store behaviour and shelf engagement without compromising customer privacy.

🎧 VC React Podcast: Episode 43

With thanks to our sponsors:

🎧 This week on VC React, we break down a Gulf food‐delivery unicorn exit, test whether prop‐tech can out‐grow fintech, and watch Silicon Valley learn that tweets have cap‐table consequences.