Happy Friday! If last week was all about fintech, this week is all about AI — well, and still fintech, actually. With the GAIN Summit in Riyadh and the Dubai AI & Web3 Festival taking place, we’ve seen a flurry of major announcements. Saudi’s aiming for AI to contribute 12% to GDP, setting the stage for Groq, Microsoft, IBM, and Nvidia to rear their heads. And fintech refuses to bow out, with FlapKap and Paymob raising big pre-Series A and Series B extension rounds. Oh, and don’t sleep on the Saudi food delivery space — Meituan’s Keeta going live might just give HungerStation and Jahez a headache. Let’s dig in 👇

P.S. 👷♀️ Our deep dive this week, is the last instalment in our two-part series on contech - a sector that has experienced a remarkable 1069.7% year-over-year increase in regional funding so far in 2024. You can check it out here.

This week’s round-up is a 7 min read:

💰 FlapKap raises $34 million in pre-Series A funding to transform SME financing in MENA

💸 Egypt’s Paymob raises $22 million in Series B extension round

🇸🇦 US closer to greenlighting Nvidia chips for Saudi Arabia

🛵 Meituan’s food delivery service Keeta goes live in The Kingdom

🔈 Catch-up on Episode 11 of the VC React Podcast

🚀 Startup funding round-up

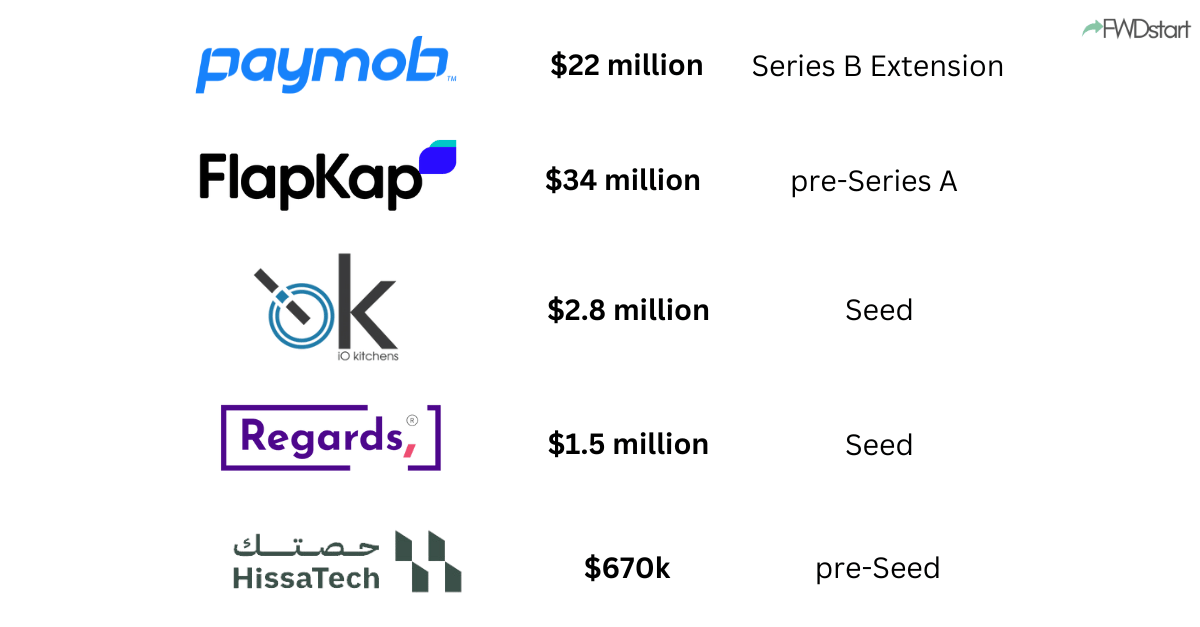

FlapKap (🇦🇪 UAE), a fintech platform offering revenue-based financing solutions, has raised a $34 million pre-Series A round, through a combination of debt and equity funding, led by BECO Capital with new investment from Pact VC, plus follow-on contributions from A15, Nclude, QED Investors, and debt financing from Channel Capital.

IO Kitchens (🇴🇲 Oman), a cloud kitchen platform that offers managed cloud kitchen facilities and a kitchen-as-a-service platform, has raised $2.8 million in a Seed funding round, led by Tanmia Small-Cap Fund and supported by a group of family offices and regional investors.

Regards (🇸🇦 KSA), a premier experience gifting platform, has raised $1.5 million in a seed funding round led by Core Vision Investment.

Hissatech (🇸🇦 KSA), a proptech platform allows individuals to co-own properties, offering rental income and potential capital gains while lowering barriers to entry for smaller investors, has raised $670k in a pre-Seed round led by unnamed angel investors.

🇯🇴 Flat6Labs Jordan graduated its sixth cohort of 7 startups, with each startup receiving up to $115k in equity funding from the program:

🇸🇦 Flat6Labs Riyadh graduated its third cohort of 10 startups, with each startup receiving up to $130k in equity funding from the program:

Phys (🇸🇦 KSA) – playtime screen time management

Clymb.ai (🇦🇪 UAE) – OS for distributors/wholesalers

Yamm (🇸🇦 KSA) – seamless refunds

Wazen (🇸🇦 KSA) – ERP/CRM/HR solutions

Wateer (🇸🇦 KSA) – digital invoicing

SARsatX (🇸🇦 KSA) – space data platform

Fahis (🇸🇦 KSA) – used car inspections

TashleehPro (🇸🇦 KSA) – auto parts hub

Money Loop (🇸🇦 KSA) – savings and lending

Holoul (🇸🇦 KSA) – quick financing solutions

Fintech

💸 Egypt-based fintech Paymob has raised $22 million in Series B extension, bringing its total Series B raise to $72 million.

Founded in 2015 by Islam Shawky, Alain El Hajj, and Mostafa El Menessy, Paymob has now raised over $90M to scale its payment services.

💰 Investor lowdown: The $22M round was led by EBRD Venture Capital and Endeavor Catalyst, with participation from PayPal Ventures, BII, FMO, A15, Nclude, and Helios Digital Ventures.

📖 The back story

In 2015, three undergraduates from the American University in Cairo — Shawky, El Hajj, and Menessy — founded Paymob after struggling to integrate payment gateways with their e-commerce platform in a market where only 2% of households shopped online.

To solve this, they launched Paymob as a digital payment infrastructure, targeting the major gap in Egypt’s online payment methods.

Since then, Paymob has grown into a comprehensive payment platform, expanding beyond Egypt to serve merchants across the UAE and Saudi Arabia, while building partnerships with global brands like Shopify and Tabby.

⚙️ Breaking it down

Paymob offers over 50 payment methods, including wallets, cards, BNPL, and QR payments, empowering 350,000+ merchants across five MENA countries to accept both online and offline payments.

Since its initial Series B in 2022, Paymob has seen 6x revenue growth and became profitable in Egypt for the first time in Q2 2023.

While still unprofitable in other regions, the company’s UAE transaction volume reached Egypt's five-year milestone in just 14 months, highlighting its rapid expansion.

By offering additional services to merchants — like Shopify integration — Paymob has been able to increase revenue per merchant, and drive margin improvements.

🐂 Bull case

Paymob’s ability to cross-sell products, scale efficiently with 1,000 employees, and achieve profitability in its core market is impressive.

Its expansion into the UAE and Saudi markets, where digital payments are growing, raises plenty of green flags for us.

🔮 Flashforward

Paymob will use the fresh funding injection to further expand across the GCC and enhance its product suite.

🤖 AI round-up

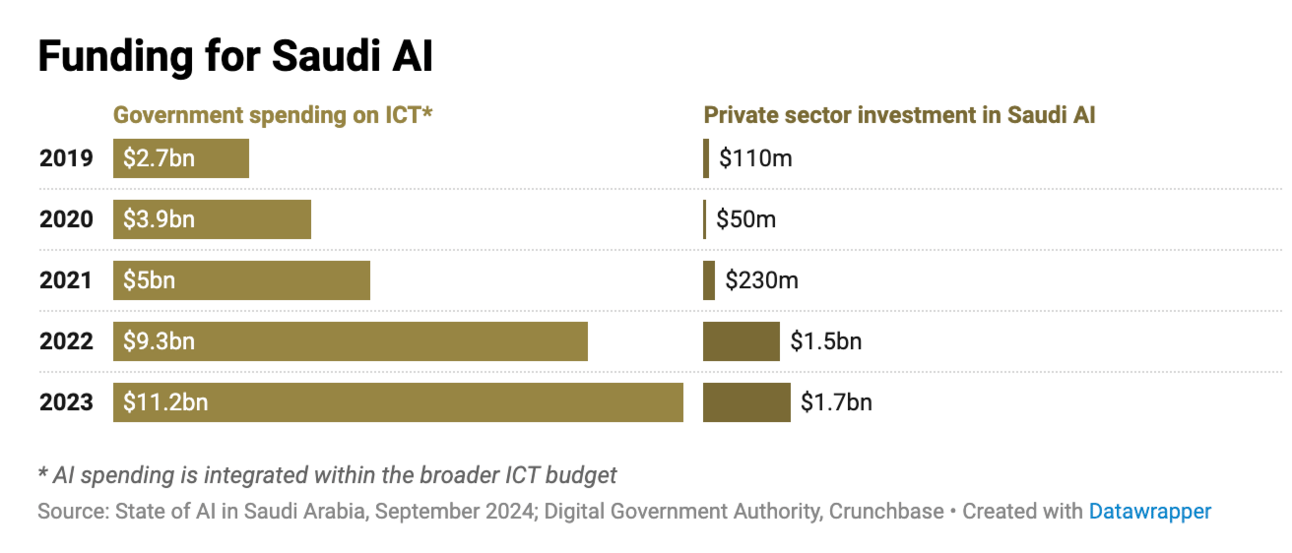

💾 The US government is considering allowing Nvidia to export advanced AI chips to Saudi Arabia, potentially aiding the country in developing powerful AI models. The topic was a key, unofficial discussion at Saudi Arabia’s global AI summit (GAIN) on Thursday, attended by representatives from Groq, Google, Qualcomm, and Saudi officials. Saudi Arabia is expecting shipments of Nvidia’s H200 chips, though Nvidia declined to comment.

🇸🇦 Saudi Arabia’s Allam, which claims to be the largest Arabic-language AI chatbot, will soon be available on Microsoft’s Azure and IBM’s WotsonX platforms. Launched by SDAIA in 2023, Allam can understand various Saudi dialects and respond in formal Arabic, without relying on translation from English. Targeting government entities, a public version will be available next year. Allam, which surpasses its regional competitor Jais in Arabic-language training data, is a national project in partnership with Nvidia and aims to serve 450 million Arabic speakers.

🏫 US AI infrastructure specialist Groq will launch a new inferencing data centre in Saudi Arabia by the end of 2024, providing 20-40% of its on-demand token-as-a-service for AI inference. Groq has also registered its regional HQ in Saudi. The company plans to deploy 25 million tokens-per-second of compute by early 2025, with long-term goals of reaching one billion tokens-per-second, enough to serve 4 billion people globally.

🇮🇳 G42 has launched NANDA, a 13-billion parameter Hindi large language model (LLM), at the UAE-India Business Forum in Mumbai. Developed with the Mohamed bin Zayed University of Artificial Intelligence (MBZUAI) and Cerebras Systems, NANDA was trained on 2.13 trillion tokens. This model will have the capacity to supports over 500 million Hindi speakers and expands G42’s portfolio beyond its Arabic LLMs like Jais.

📊 King Salman Global Academy for Arabic Language (KSGAAL) and SDAIA have launched the Balsam Index, a tool to evaluate and benchmark Arabic large language models (LLMs) and natural language processing (NLP) models. With 50,000 questions for testing, the index assesses the quality of Arabic text generated by AI models, and future developments may include evaluating voice and sign language.

💸 Acquisitions round-up

🏍️ Mubadala has officially submitted an application to Turkey's antitrust regulator to acquire full control of Getir, the Turkish-based delivery platform. In June, Getir announced plans to split its operations into two distinct entities. The first will focus on food and grocery delivery within Turkey and be majority-owned by Mubadala, an existing investor. The second entity will manage Getir's other assets, including Getir Drive and the ride-hailing service BiTaksi.

🤝 Entlaq, an Egypt-based company supporting entrepreneurs, has acquired a stake in the Egyptian foodtech Brotinni for an undisclosed value. Founded in 2020 by Dalia Abu Omar, Brotinni is a dark store that allows customers to buy their needs of meat and poultry online. The new investment will allow Brotinni to expand its operations within Egypt and other regional markets. In 2022, Brotinni raised a $600,000 Seed round, led by Innlife investments.

🌺 Acasia Group has been acquired by Hawaii-based VC firm Sultan Ventures, led by Omar and Tarik Sultan. Founded in 2011 by Aly El Shalakany as Cairo Angels, Acasia grew from a grassroots angel syndicate into offering startup programs, incubators, and competitions in partnership with organisations like EG Bank and the World Bank. Sultan Ventures, known for its XLR8® accelerator, has a track record of scaling U.S. startups and now aims to bring its venture acceleration model to MENA.

💰 VC round-up

🇪🇬 Egypt’s ITIDA, Telecom Egypt, Applied Innovation Center, and Tsinghua Unigroup signed an MoU during the China-Africa Cooperation Forum Summit in Beijing. They will co-launch a $300 million technology investment fund focused on AI and semiconductor innovation, with Tsinghua contributing 60-70% of the capital.

The partnership includes developing AI applications, particularly Arabic large language models, and advancing Egypt’s tech capabilities. Tsinghua will also establish a data center, cloud services, and explore an R&D center specialising in chip design and systems engineering in Egypt.

⌨️ Tech round-up

🛵 Meituan's Keeta has officially launched its beta phase in Riyadh, stirring excitement and concern among local food delivery players. Saudi Arabia's market is currently dominated by HungerStation, owned by Delivery Hero, and the profitable Jahez. Smaller players like The Chefz, Mr Mandoob, Mrsool, and Ninja also compete.

Keeta, backed by Meituan, is making a bold entry, reportedly allocating 1 billion SAR ($266 million) for marketing and planning to undercut competitors with lower commission fees — expected to be 10-12%, compared to HungerStation’s 18-25% and Jahez’s 12-13%. Keeta has already onboarded 5,000 F&B merchants and aims to keep delivery costs low, potentially charging just 1 SAR per order, far below HungerStation's average of 16 SAR.

🎧 In this week's episode of the VC React Podcast, fintech took centre stage following the 24 Fintech event in Riyadh. It was a crazy week with plenty of major funding rounds, acquisitions, and announcements.

On the acquisition front, Tabby acquired Saudi digital wallet Tweeq, as part of their expansion beyond BNPL. Meanwhile, Tamara received preliminary approval from SAMA for a consumer finance license, and Tarabut acquired UK-based Vyne to offer instant bank-linked payments, starting with their first customer in Bahrain.

We also covered Ziina raising $22 million to shift from payments to full financial services, and Malaa Technologies securing $17.3 million to simplify financial management.

This week, Ahmad and I were joined by:

Hasan Haider, Founder and Managing Partner at Plus VC (+VC)

Karim Samakie, Advisor at Fintech Saudi

Kevin Holliday, Managing Director at C3 - Companies Creating Change

📰 Recommended Reads

Nalin Patel. MENA Private Capital Breakdown

GAIN Summit. State of AI in Saudi Arabia

Mal Filipowska. What's going on in the Qatari VC ecosystem?

👋 Message from the team

Thanks for reading this week’s edition!

If you’re enjoying the newsletter, don’t forget to share it with a friend!

Have a question or any feedback? Just hit reply, or provide a rating below - we want to hear from you!!

How was this newsletter edition?

Was this forwarded to you? Sign up here.