Welcome back, and a very big hello to the 107 new subscribers who have joined FWDstart since last week! 👋

This week’s edition marks the final instalment of our deep dive into the MENA contech space. Last week, we explored how YC-backed Tenderd is playing a crucial role in keeping track of the region’s mega-projects.

If you missed it, catch up here 👈

Today, we’ll dive into how 2024 has become a breakout year for the MENA contech startup ecosystem, with companies like BRKZ, Wakecap, and Procurified driving innovation in a sector traditionally very, very slow to embrace change.

Back in the mid-2000s, reports claimed Dubai housed a quarter of the world’s 125,000 cranes.

In reality, it was no more than 2%, but the sentiment was clear — the pace of construction in the emirate was remarkable.

Over the next decade, the UAE's rapid development, set against the backdrop of the 2008 global financial crisis and the Arab Spring, transformed both its landscape and society.

This morning, as I look out my window in Abu Dhabi, I see cranes stretched into the sky, assembling the next piece of a concrete jungle jigsaw that less than 20 years ago, was just a vast desert.

But, the UAE’s construction boom is no longer unique in the region.

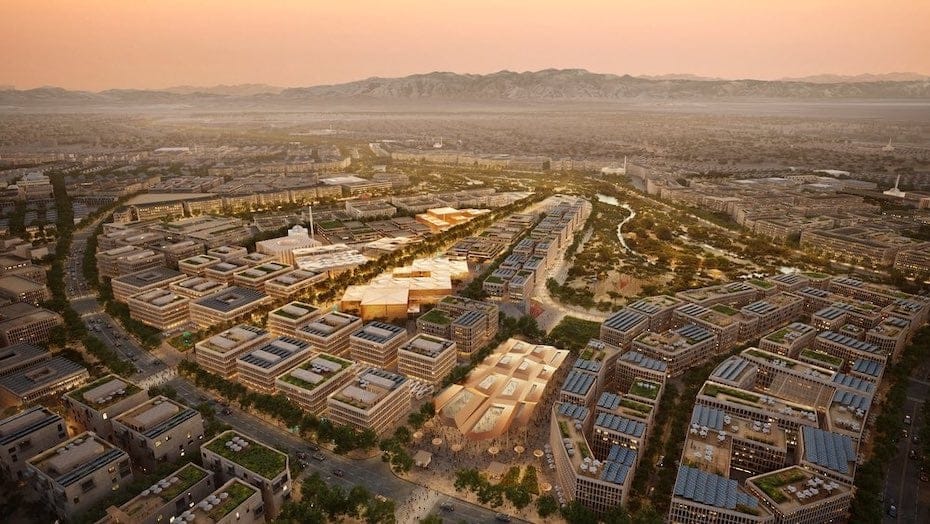

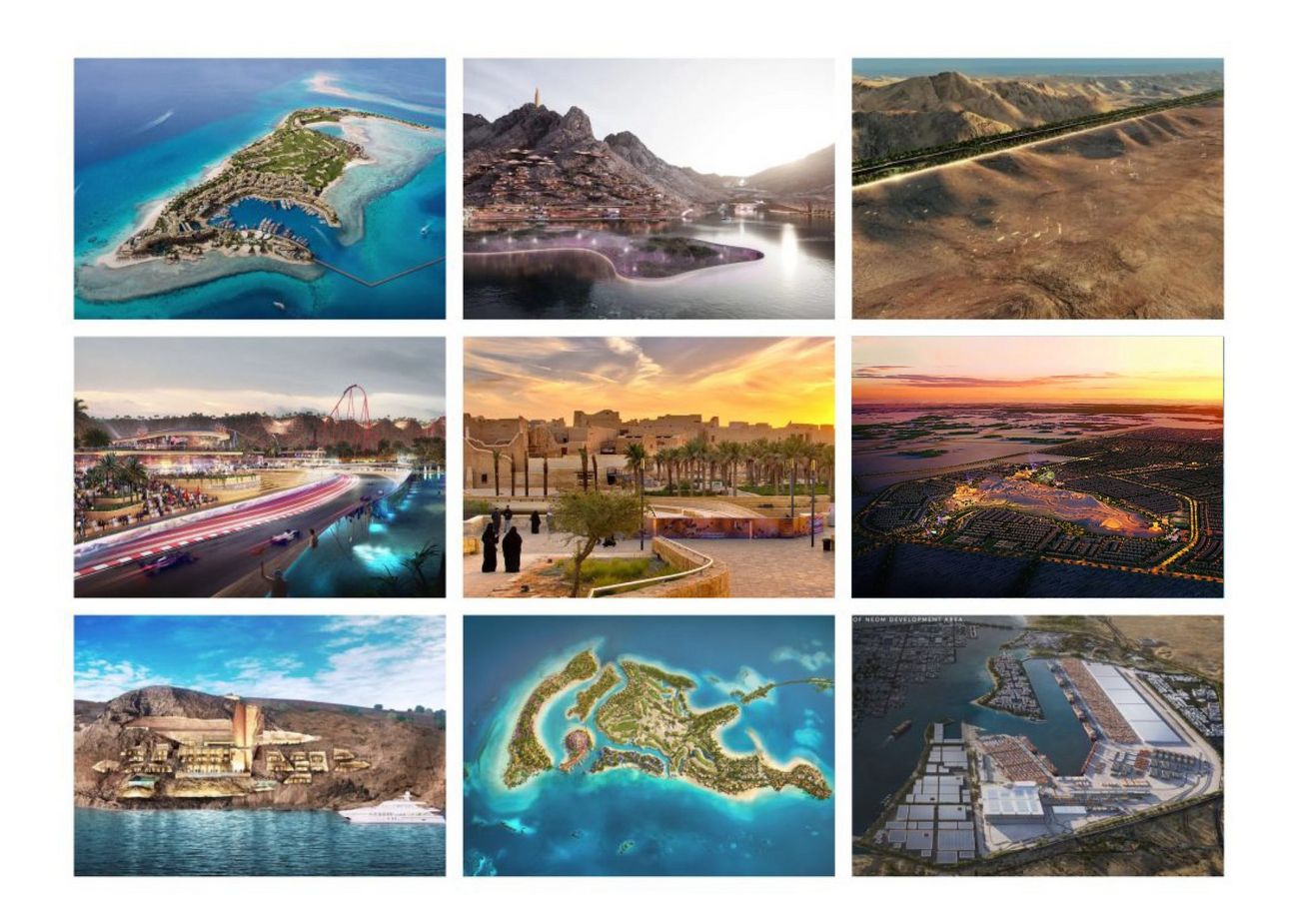

🇸🇦 Saudi Arabia’s bold and ambitious giga-projects like The Line in NEOM, Trojena, and Jeddah Tower have captured global attention as part of the Kingdom’s Vision 2030 plan to diversify beyond oil.

Saudi giga-projects

Other nations are following suit:

🇪🇬 Egypt’s New Administrative Capital is taking shape east of Cairo, and a $35 billion deal with the UAE aims to develop the Ras al-Hekma peninsula along the Mediterranean.

🇶🇦 Qatar spent over $220 billion on infrastructure for the 2022 World Cup.

🇮🇶 Iraq has launched the $17 billion Development Road project to link it to Türkiye, transforming the region into a logistics hub.

🇴🇲 Oman’s Sultan Haitham City offers a more modest but equally important vision of a livable, sustainable city, breaking from the “Dubai archetype.”

As the region's resource-dependent economies accelerate diversification, construction is central to these efforts.

The remainder of this article is for paid subscribers only.

Get access to the strategies, tactics, and wisdom of MENA's best investors, founders and operators with a paid subscription.

👷♂️ State of play

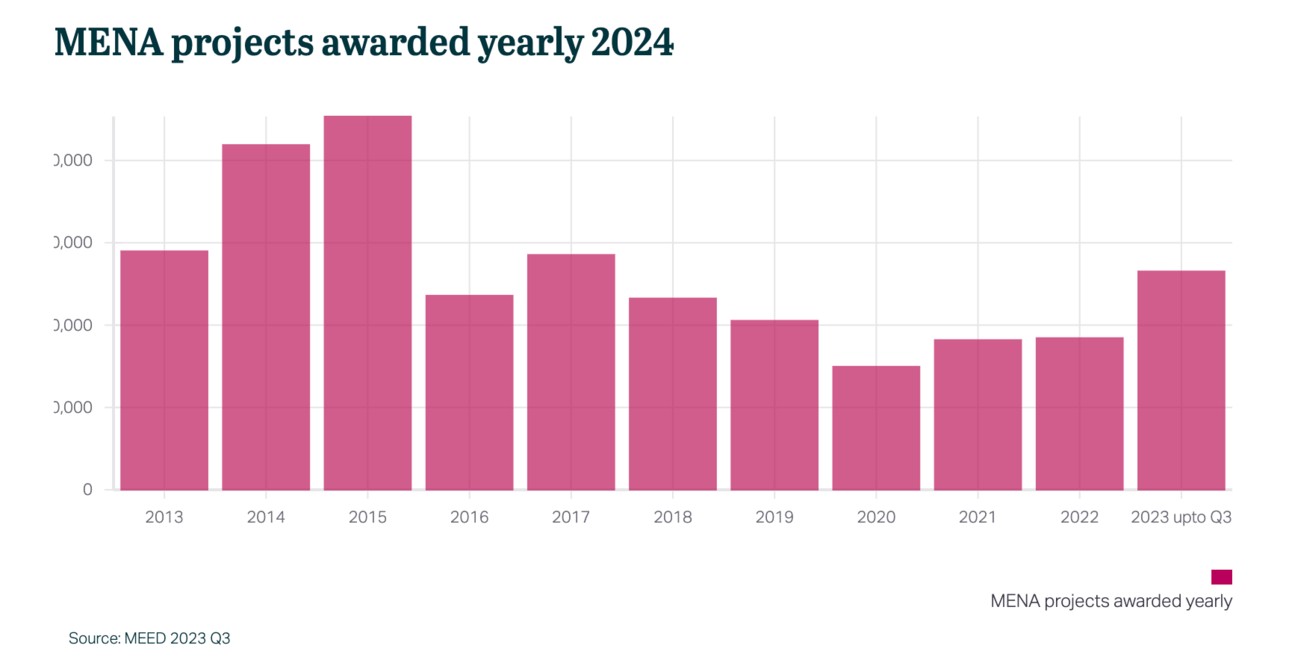

In this context, 2024 has emerged as a breakout year for the MENA region’s contech ecosystem.

In the first half alone, $38.6 million was raised across four deals, compared to just $3.3 million raised across eight deals in all of 2023.

That’s a 1069.7% increase year-on-year.

1️⃣ Why the slow adoption of innovation?

The remainder of this newsletter is for paid subscribers only.

Don’t miss out! Become a member today.

A subscription gets you full access to our weekly deep-dives, which include:

✅ Analysis, case studies and interviews unpacking trends, companies, or industries, and more.

✅ Access to the strategies, tactics, and wisdom of MENA's best investors and founders.

✅ Practical and actionable guides designed to make you a better investor and technologist.

✅ Unlimited access to our online archive where you can read previous editions of the newsletter.

🔮 Outlook

Deal flow is improving, with funding totals seeing a sharp rise.

Saudi’s Wakecap is expanding into the U.S. after acquiring a Silicon Valley startup, while Tenderd, the YC-backed UAE startup, has raised $30 million in Series A and is eyeing international markets. BRKZ, meanwhile, is scaling fast, aiming to capture more of the regional market.

Investor interest is unmistakably there.

Wa’ed Ventures, for example, co-led a $52 million Series B in US-based Mighty Buildings, paving the way for manufacturing operations in Saudi Arabia and the UAE.

Yet, the challenge remains: the region lacks a deep pipeline of startups ready to absorb this capital.

This is why the emergence of contech-focused accelerators is so critical.

Flat6Labs, SIAC, and Dar Launch “Makers” ConTech Accelerator Program

The Flat6Labs "Makers" ConTech Accelerator, the region’s first construction-focused accelerator, offers startups up to $100,000 in funding, pilot project access, and mentorship. Initially focused on Egypt, the program hopes to expand to Saudi Arabia and MENA in the near future.

Similarly, Startup Wise Guys launched a Construction Tech Accelerator in Saudi Arabia, backed by SEEDRA Ventures and the National Technology Development Program (NTDP), providing startups with funding, mentorship, and market access.

Looking ahead, the success of these programs will depend on more than just funding.

Startups will need to navigate regulatory challenges, scale across fragmented local markets, and incorporate advanced tech like AI, robotics, and 3D printing to truly disrupt the industry.

Do we have the requisite talent to achieve that? Yes, I believe we do.

As we’ve seen in other sectors, early success stories inspire the next generation of founders.

We have a foundation, now it’s time to build.

👋 Message from the team

Thanks for reading this week’s edition!

If you’re enjoying the newsletter, don’t forget to share it with a friend!

Have a question or any feedback? Just hit reply, or provide a rating below - we want to hear from you!!

How was this newsletter edition?

Was this forwarded to you? Sign up here.