Happy Friday, friends 👋

“Travis Kalanick’s CloudKitchens MENA division potentially IPOing in Saudi” was not a sentence I expected to write earlier this week – but alas – here we are.

Goldman Sachs has reportedly been hired to assess the possible listing of KitchenPark, Kalanick’s ghost kitchen company operating in the UAE, Saudi Arabia, and Kuwait. The business has been backed by Saudi’s Public Investment Fund since 2019, when it invested $400 million.

If it moves ahead, the IPO would bring KitchenPark into more direct competition with Dubai-based Kitopi – the regional category leader, now expanding into physical locations after reaching unicorn status in 2021.

Nothing is confirmed yet on valuation or timing, but a listing would add a new layer to the evolving cloud kitchen chessboard in the Gulf.

This is a long one, so we recommend enjoying this week's edition online 👇

This week’s round-up is a 7 min read:

💸 Saudi-based erad raises $16M pre-Series A for Shariah-compliant, data-driven SME financing platform

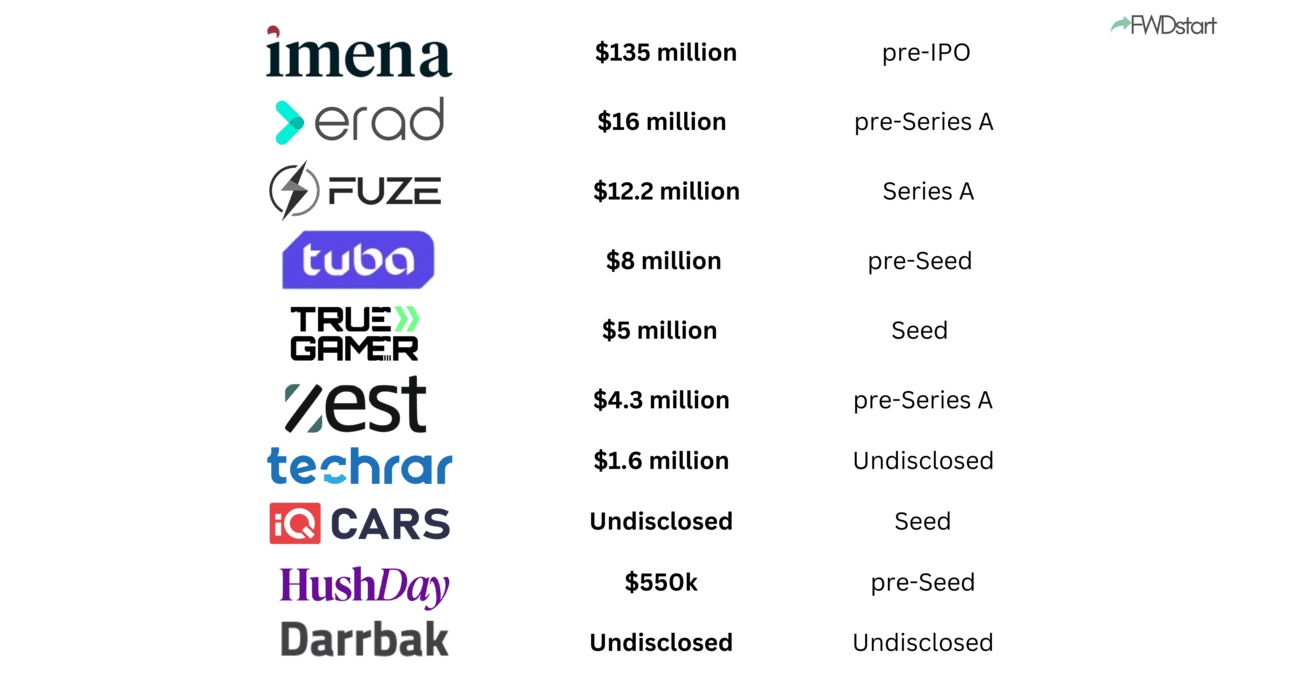

🚀 Startup funding round-up

iMENA Holding (🇸🇦 KSA), a digital platform operator behind OpenSooq, SellAnyCar, and Jeeny, has raised $135 million in the first tranche of its pre-IPO round from Sanabil Investments (PIF), FJ Labs, Saygin Yalcin, and other prominent Saudi investors.

erad (🇸🇦 KSA), a Shariah-compliant, data-driven financing platform for SMEs, has raised $16 million in a pre-Series A round backed by Y Combinator, Nuwa Capital, Khwarizmi Ventures, Aljazira Capital, VentureSouq, Oraseya Capital, and Joa Capital.

Fuze (🇦🇪 UAE), a digital assets infrastructure provider enabling banks and fintechs to offer regulated crypto and stablecoin products, has raised $12.2 million in a Series A round led by Galaxy and e& capital, with participation from Further Ventures.

Tuba (🇸🇦 KSA), a healthtech startup using AI to improve healthcare management and operational efficiency, has raised $8 million in a pre-Seed round led by Al-Waalan Investment, with participation from angel investors.

True Gamers (🇦🇪 UAE), a gaming company operating esports cafes, has secured $5 million in a Seed round to expand its presence and enhance its gaming infrastructure.

Zest Equity (🇦🇪 UAE), a private market infrastructure platform digitising SPVs, cap table workflows, and secondary trading has raised $4.3 million in a pre-Series A round led by Prosus Ventures, with participation from Morgan Stanley Inclusive and Sustainable Ventures (MSISV).

Techrar (🇸🇦 KSA), a platform for managing subscriptions, memberships, and recurring billing, has raised $1.6 million in a funding round led by Wa’ed Ventures, the VC arm of Aramco.

iQ Cars (🇮🇶 Iraq), an online car marketplace with 34,000+ listings and 1,000+ dealers, has raised a 7-figure Seed round led by Euphrates Ventures to scale operations and advance transparency in Iraq’s automotive sector.

Hushday (🇦🇪 UAE), a premium e-commerce platform offering invitation-only access to luxury brands’ excess inventory, has raised $550k in a pre-Seed round from undisclosed regional investors.

Darbak Plus (🇴🇲 Oman), a tourism tech platform offering online booking for customised travel experiences across Oman, has received an undisclosed pre-Seed investment from Oman Future, the investment fund of the Oman Investment Authority.

Premium deep-dive

Jad Fadl, Founder of MENA+

The mechanics of how to build a high-performing syndicate, why values alignment is a competitive moat, and the MENA+ diasporic founders you should know.

Funding

iMENA Holding raises $135M and restructures as Saudi company ahead of IPO

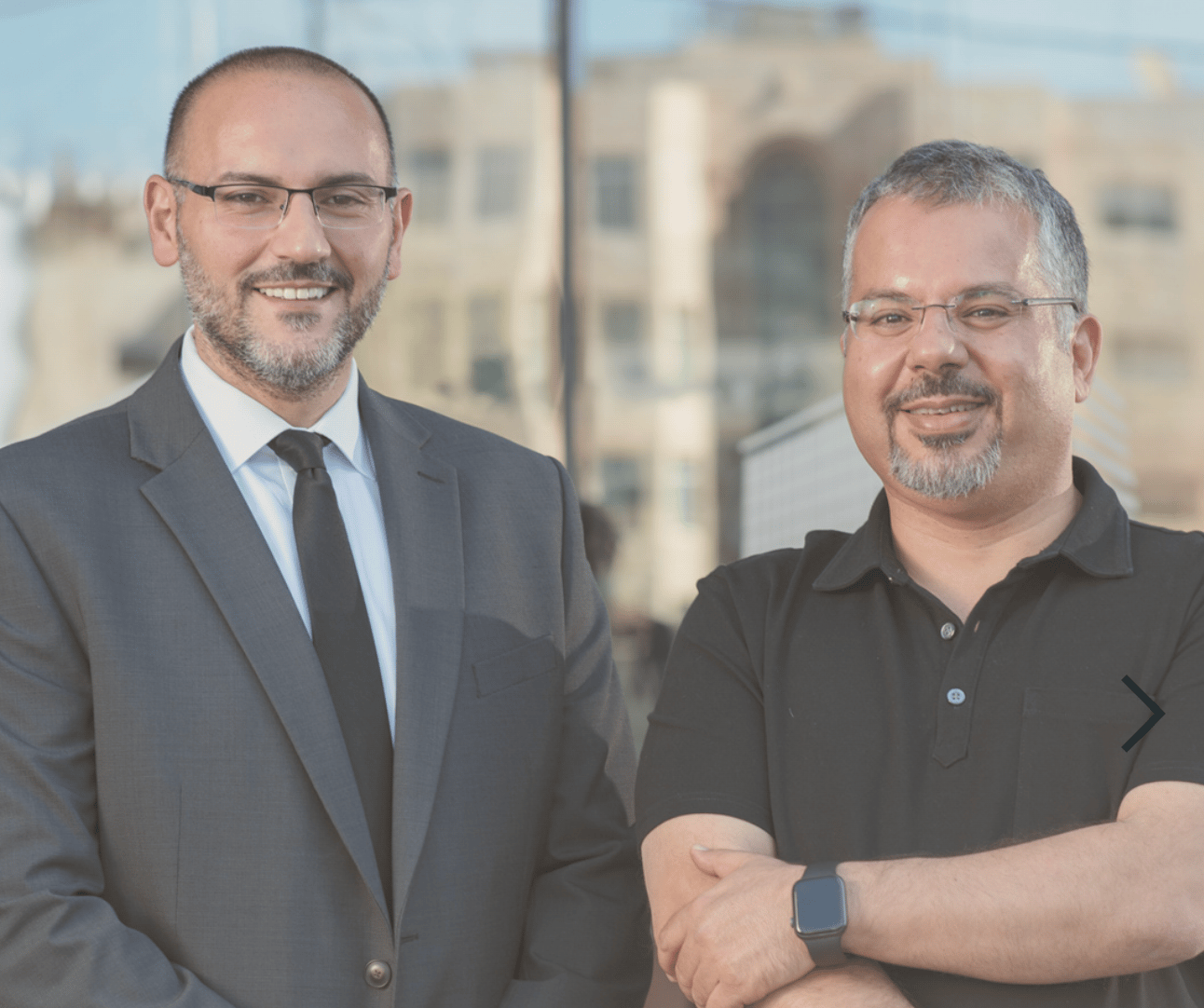

Adey Salamin and Khaldoon Tabaza, Co-founders of iMENA

UAE-based iMENA Group has raised $135 million in the first tranche of its pre-IPO round to double down on its portfolio of digital platforms across real estate, mobility, and automotive. The raise includes private placement and in-kind contributions.

The round was backed by Sanabil Investments (Public Investment Fund), FJ Labs, Saygin Yalcin (Founder of SellAnyCar.com), and several prominent Saudi investors.

FJ Labs’ participation is worth zooming in on. With a portfolio that includes Alibaba, Coupang, Rappi, Wallapop, and Delivery Hero, FJ Labs has backed more than 30 unicorns and built one of the largest global portfolios of marketplace startups.

💸 VC

💼 Riyadh-based STV has closed its inaugural non-dilutive capital fund, STV NICE Fund I, backed by SAB Invest’s Alternative Financing Fund and supported by the National Technology Development Program (NTDP). Using a Sharia-compliant Non-Dilutive Investment in Callable Equity (NICE) structure, the fund provides growth-stage Saudi tech startups like Morni, RedBox, and Invygo with founder-friendly capital that avoids equity dilution. The fund marks a major step in addressing the Kingdom’s venture funding gap by offering steady income to investors while supporting tech innovation—aligning with Vision 2030 and CMA’s push for innovative, public-private financial instruments.

💊 The Gates Foundation-backed i3 programme has selected seven growth-stage healthtech startups – Chefaa, Dawa Mkononi, Meditect, mPharma, myDawa, RxAll, and Sproxil – to receive up to $225,000 each, along with access to markets and tailored partnerships, as part of its third cohort. The pan-African initiative, also supported by MSD, Sanofi, and Cencora, aims to scale pharmacy-focused innovations across 19 countries, tackling challenges from last-mile delivery to AI-powered refills.

🧭 Jaree, a new Saudi-based investment platform founded by Faisal AlNaji and Noura AlNahedh, has launched to match early-stage startups with accredited investors. Built to address the disconnect between quality startups and investor access, Jaree offers curated deal flow, co-investment opportunities, and structured support for both sides of the market. Unlike open platforms, it focuses on Saudi-based startups with traction and scale potential.

🌍 International investments

🩺 Pakistan-founded health tech startup MedIQ, led by Dr. Saira Siddique, has raised $6 million in a Series A round co-led by Qatar’s Rasmal Ventures and Saudi Arabia’s Joa Capital to fuel its expansion across the GCC. With operations already underway in Saudi Arabia, where it claims early market leadership, MedIQ is scaling an AI-powered, integrated digital health platform spanning telehealth, e-pharmacy, RCM, and decision support tools. The company, now EBITDA-positive and serving over 10 million users.

🧬 Armenia-based Denovo Sciences has secured investment from Qatar-based Alchemist Doha to advance its AI-driven drug discovery platform and deepen its presence in Qatar. Founded by Hovakim Zakaryan, Denovo is using reinforcement learning to design novel, synthetically accessible compounds without relying on large datasets — a breakthrough for tackling “undruggable” diseases and complex multi-target conditions.

Salah et Khalil El Hajji, Co-founders CleanMob

🚗 Morocco-based CleanMob has raised $1.4 million in a round led by MNF Ventures, CDG Invest, Bpifrance, and Tremplin Capital to scale its AI-powered fleet management platform. Founded by brothers Khalil and Salah EL HAJJI, the startup replaces costly telematics hardware with proprietary virtual sensor tech that combines signal processing, predictive AI, and physical modeling to optimize data from multi-energy vehicle fleets.

🧠 BloomPath, a US-based SaaS startup founded in 2024 by Mohammad Kotb and Ahmed Gad, has raised $1.3 million in a pre-seed round led by RAED Ventures, with backing from Ulu Ventures, Wamda Capital, +VC, and several angels. Built by MENA talent and headquartered in the U.S., BloomPath offers AI-driven, in-flow software to help engineering teams track goals, spot performance patterns, and improve alignment—positioning itself as an “Apple Watch for the workplace.”

💸 Alpaca, a US-based brokerage infrastructure startup co-founded by Yoshi Yokokawa, has raised $52 million in a Series C round to fuel its global expansion, including deeper moves into the Middle East and Asia. The raise saw participation from both new and returning investors, including Saudi Arabia’s Derayah Financial and Kuwait’s National Investments Company (NIC), reflecting growing MENA investor interest in embedded fintech infrastructure.

🤝 New Entrants

📊 Uniqus, an India-founded consulting-tech platform, has raised $20 million in a Series C round led by Nexus Venture Partners, with Sorin Investments also participating, to scale its AI-driven accounting, reporting, and risk management solutions. Founded in 2022, the company has quickly grown to 550+ professionals across 11 cities, with strong Middle East traction via offices in Dubai, Abu Dhabi, and Riyadh and clients like Al Rajhi Bank and Bahri Shipping. The new funding will fuel expansion into Qatar, Bahrain, Kuwait, and Oman, as Uniqus positions itself as a tech-forward alternative to traditional consultancies.

📈 Public Markets

Travis Kalanick

🍽️ Travis Kalanick’s CloudKitchens is reportedly exploring an IPO for its Middle East unit, with Goldman Sachs hired to assess a potential listing in the UAE or Saudi Arabia. Backed by Saudi Arabia’s PIF since a $400M investment in 2019, the ghost kitchen company operates under the KitchenPark brand in the UAE, Saudi, and Kuwait. The move puts it on a potential collision course with Dubai-based Kitopi, the regional category leader that became a unicorn in 2021 and has since expanded into physical dining spaces. No final decision has been made on timing or valuation, but the IPO could signal rising competition — and consolidation — in the Gulf’s cloud kitchen space.

💄 Riyadh-based beauty e-commerce platform Nice One, which listed on the Tadawul in January, reported a 10.2% YoY rise in Q1 2025 net profit to $6.4M, with revenues up 30% to $86.7M – driven by a surge in customer orders during Ramadan. Despite stronger gross and operating income, profit gains were tempered by higher costs and Zakat charges. Shares fell 2.8% post-earnings and are down over 30% in the last three months, though still trading above IPO levels. Once valued at over $2B, Nice One now holds a market cap of $1.17B as investors weigh growth momentum against margin pressure.

🤝 Mergers

🤝 Saudi-based health tech platforms Miran and Welnes have merged to create a unified AI-powered fitness and wellness ecosystem, combining Miran’s personalised nutrition and workout engine with Welnes’ coach-led community platform. Backed by Flat6Labs, Samurai Incubate, UI Investments, and led by angel investors including a Doroob VC member, Welnes’ merger reflects growing investor momentum in Saudi Arabia’s wellness space. With Amr Saleh as CEO and Eslam Ali as CTO, the newly combined company will operate from Riyadh, aiming to support Vision 2030 by promoting healthier lifestyles through tech-driven, socially engaging fitness solutions.

🤖 AI

🤖 Meta has launched its dedicated Meta AI app in the MENA region, giving users a centralised space to manage and personalise their daily AI interactions across devices. Available now on iOS and Android, the app features a chat homepage, a Discover tab for prompt sharing, a History tab to revisit past interactions, and a Devices tab for managing smart products like Ray-Ban Meta Smart Glasses. While advanced features like full-duplex voice conversations and memory-based personalization—powered by Llama 4—are currently US-only, the rollout marks Meta’s push to integrate AI more deeply into everyday social and device experiences across MENA.

💰 Fintech

💳 Visa and Bridge, the Stripe-owned stablecoin infrastructure platform, have launched a card-issuing product that lets users spend stablecoin balances at any Visa-accepting merchant. Now live in six Latin American countries, the offering allows fintech developers to issue Visa cards linked to stablecoin wallets, marking a leap in stablecoin utility and everyday integration. Following Stripe’s acquisition of Bridge in February, the move aligns with Visa’s growing focus on programmable, interoperable payment rails—having already surpassed $200M in stablecoin settlements. Expansion to Africa, Asia, and Europe is expected soon, as Visa and Mastercard race to embed stablecoins into mainstream payments.

This episode is brought to you by OCTA - AR Automation – the AI-powered accounts receivable platform trusted by 100+ companies like Careem, Lean Technologies, and ZenHR to automate collections, resolve disputes, and unlock financing with zero hassle.

👉 Visit www.weareocta.com/fwdstart to get your first 6 months free

🎧 This week on the VC React Podcast, we look at a dealmaking trifecta that cuts across edtech, crypto, and venture strategy — from the first signs of an M&A path in Arabic learning, to one of the largest token collapses MENA’s seen this year, to a global VC fund leaning into replication across emerging markets.

📆 Events and Opportunities

🇸🇦 WomenSpark, powered by Playbook, is hosting an exclusive Demo Day to spotlight female-founded startups in the region. The event offers founders the chance to pitch their product, connect with investors, and access new growth opportunities. With just 2% of VC funding going to women-led startups globally, this initiative aims to close the gap and elevate women in tech and entrepreneurship. Apply to pitch.

📚 What we’re reading

👋 Message from the team

Thanks for reading this week’s edition!

Have a question or any feedback? Just hit reply, or provide a rating below - we want to hear from you!