UAE-based iMENA Group has raised $135 million in the first tranche of its pre-IPO round to double down on its portfolio of digital platforms across real estate, mobility, and automotive. The raise includes private placement and in-kind contributions.

The round was backed by Sanabil Investments (Public Investment Fund), FJ Labs, Saygin Yalcin (Founder of SellAnyCar.com), and several prominent Saudi investors.

FJ Labs’ participation is worth zooming in on. With a portfolio that includes Alibaba, Coupang, Rappi, Wallapop, and Delivery Hero, FJ Labs has backed more than 30 unicorns and built one of the largest global portfolios of marketplace startups. Founding Partner Fabrice Grinda was actually on 20VC’s new weekly roundup show this week, which I recommend checking out here.

⏪ Background

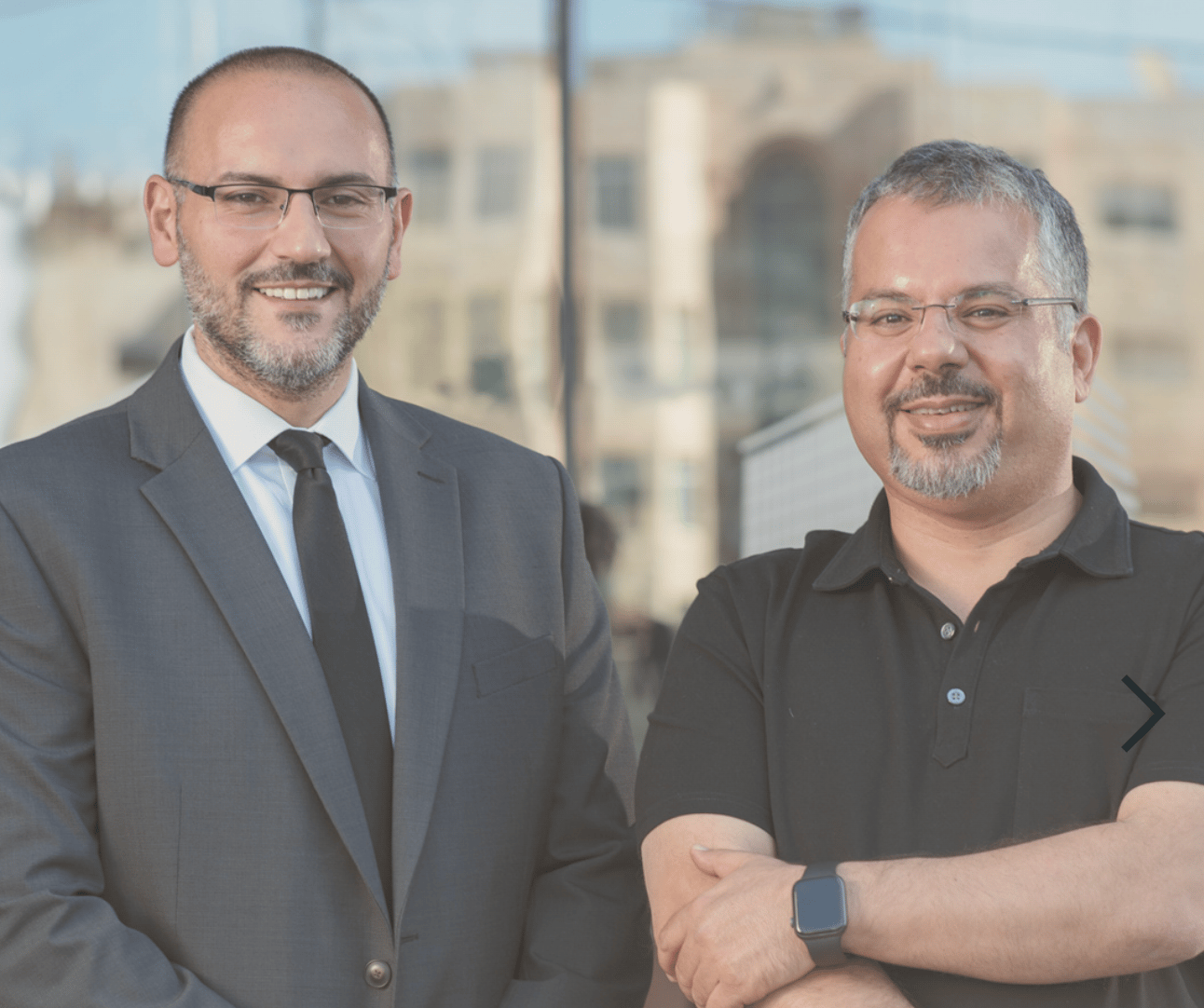

iMENA was founded in 2012 by Nasir Alsharif, Khaldoon Tabaza, and Adey Salamin. It has now restructured into a Saudi Closed Joint Stock Company (CJSC) under the name iMENA Holding, ahead of a planned IPO.

iMENA’s thesis is to own and operate category-leading platforms in large, high-frequency verticals — then consolidate them under a holding structure.

The group currently controls OpenSooq, SellAnyCar, and Jeeny — three digital platforms with strong market positions across the Middle East, especially in Saudi Arabia and the UAE, which together account for nearly 80% of group revenues.

📖 What does the company do?

iMENA operates and invests in:

OpenSooq: one of the region’s largest classifieds platforms

SellAnyCar: a tech-driven used car marketplace and resale platform

Jeeny: a ride-hailing app operating in KSA and Jordan

The group focuses on asset-light, digital-first businesses that scale through network effects, localised operations, and category dominance.

The recent fundraise will be used to increase iMENA’s shareholding in these companies, deepen vertical integration, and expand geographically.

🔮 Outlook

With strategic capital from state-linked and globally seasoned investors, iMENA is positioning itself to become one of the first homegrown tech holding companies to go public.