Happy Friday, friends 👋

With conference season kicking into full swing next week at LEAP in Riyadh, we wish you safe travels, productive meetings, and plenty of patience for the inevitable traffic.

We’re happy to report we survived our debut keynote on the State of the MENA Ecosystem at the Sharjah Entrepreneurship Festival last weekend. Huge thanks to everyone who joined us, and a special shoutout to Tarun Krishna for the invite!

Now, without further ado, enjoy this week’s edition! 👇

This week’s round-up is a 6 min read:

🛍️ Dubai-based Qeen.ai raises $10M Seed to scale agentic AI automation for e-commerce

💰 Egypt’s Khazna secures $16M for its financial super app and expansion into KSA

🇶🇦 QIA’s $1 billion fund of funds kicks off with investment in Rasmal Ventures

🇸🇦 SVC impact report reveals $1 billion in investments across 54 funds

🔈 Catch-up on Episode 23 of the VC React Podcast

You’ll get access to analysis, case studies, playbooks and interviews unpacking trends, companies, industries, and more. Become a member today.

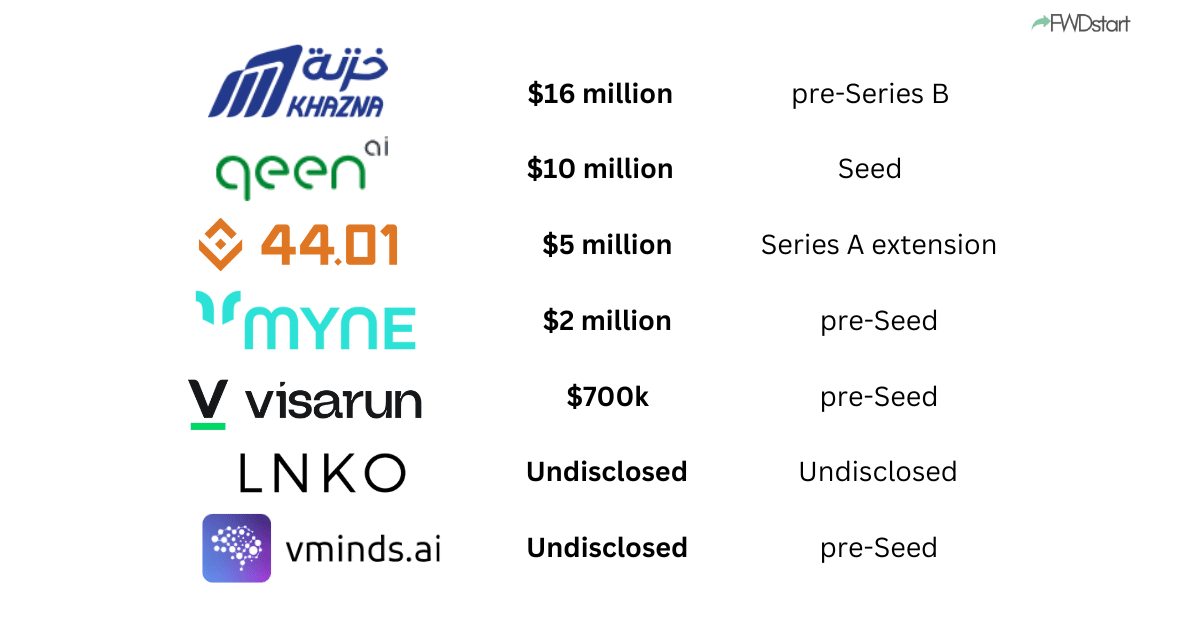

🚀 Startup funding round-up

Khazna (🇪🇬 Egypt), a fintech firm focused on providing financial services to the underbanked, has secured $16 million in a pre-Series B round, led by SANAD Fund for MSME, anb Seed Fund, Aljazira Capital, and others.

44.01 (🇴🇲 Oman), a climate tech company specialising in CO₂ mineralization technology, has raised an additional $5 million in its Series A, bringing the total to $42 million, with contributions from Norwegian sovereign investor Nysnø Climate Investments and MENA-focused VC fund Jasoor Ventures.

Karim Chouman (Founder of Myne)

Myne (🇦🇪 UAE), a wealth management platform offering asset tracking, real-time market integration, live budgeting tools, and digitised estate planning, has raised $2 million in a pre-Seed round led by Scene Holding, with participation from Raz Holding, Plus VC, Annex Investments, and other angel investors.

VISARUN (🇦🇪 UAE), a visa-as-a-service platform that streamlines visa processing has raised $700,000 in pre-Seed funding from unnamed angel investors.

vminds.ai (🇸🇦 Saudi Arabia), an AI startup consolidating over 150 global AI tools into a single platform, has secured a six-figure pre-Seed investment from undisclosed angel investors.

LNKO (🇲🇦 Morocco), a D2C eyewear company, has received an undisclosed investment from Egypt's Beltone Venture Capital to support LNKO's expansion across Africa.

AI

🛍️ Dubai-based Qeen.ai raises $10M to scale agentic AI automation for e-commerce

Dubai-HQ’d Qeen.ai has secured $10 million in a Seed round to expand its AI-driven e-commerce automation platform.

💰 Investor lowdown: The round was led by Prosus Ventures, with participation from Wamda Capital, 10X Founders Fund, and Dara Holdings.

With this raise, Qeen.ai has now secured $12 million in total funding, following a $2 million pre-seed round in 2023.

⚙️ Breaking it down

Founded in 2023, Qeen.ai provides AI-powered automation agents that help e-commerce businesses scale marketing, content creation, and conversational sales without relying on expensive agencies or deep advertising expertise. Its proprietary RL-UI technology continuously learns from consumer interactions, refining marketing strategies in real time.

One example of this AI in action is dynamic text personalisation, where the AI adjusts content based on user behaviour and device type. So, for example, an iPhone user sees quick bullet points, while a laptop user receives a more detailed paragraph.

Since launching its Dynamic Content agent in Q2 2024, Qeen.ai claims to have served over 15 million users, generated more than 1 million SKU descriptions, and helped merchants increase sales by 30%.

💵 How Qeen.ai makes money

The company operates on a subscription-based model with two main revenue streams:

Content automation is priced per active SKU, typically between $0.10 and $0.20 per SKU per month.

Its AI marketing agent follows a per-interaction pricing structure, allowing businesses to pay based on usage.

🐂 Bull case

Unlike most AI-powered marketing startups focused on the U.S. and Europe, Qeen.ai is scaling first in MENA, positioning itself as the region’s AI-driven e-commerce leader, with the market expected to reach $50 billion by 2025, driven by growth in Saudi Arabia and the UAE.

The company has assembled a powerhouse team, led by Morteza Ibrahimi (CEO), a former DeepMind researcher specialising in self-learning AI agents, Ahmad Khwileh (CTO), an AI specialist formerly at Google Ads, and Dina Alsamhan (CBO), an e-commerce strategist with experience at Google Ads.

It’s attracted top AI talent from the Bay Area, Europe, and the UK, building a strong base in UAE and Jordan.

🔮 Flashforward

Looking ahead, Qeen.ai plans to expand its AI platform, scale its merchant automation tools, and grow its team, which currently stands at over 25 employees across UAE and Jordan.

Premium deep-dive

Why it's so difficult, the benefits of offering LLM flexibility, and how AI is changing the enterprise pricing model, in conversation with Ahmed Mahmoud, CEO of DXwand.

💰 VC

🇶🇦 Rasmal Ventures has secured backing from the Qatar Investment Authority (QIA) through its $1 billion Fund of Funds program, becoming the first VC fund supported under the initiative. Its inaugural fund, Rasmal Innovation Fund I LLC, targets high-potential startups in fintech, B2B SaaS, healthtech, and AI. Launched in June 2024, the fund has already raised $30 million toward its $100 million target and last week announced its first investment, co-leading a $7.6 million round in Turkey-based TeamSec, an AI-powered Securitisation-as-a-Service platform.

🇪🇬 Foundation Ventures, an Egypt-based VC firm, has announced the first close of its $25 million fund, FVFII. It’s backed by the Egyptian American Enterprise Fund (EAEF), MSMEDA, and Onsi Sawiris. Foundation Ventures was founded in 2019 by Mazen Nadim, Omar Barakat, and Ziyad Hamdy – and has backed prominent startups such as Trella, Abwaab, Rabbit, and Swypex.

VC Funds backed by SVC

💰 SVC has disclosed in its Impact Report that since its inception in 2018, it has committed a total of $1 billion in investments, contributing to a collective investment pool of approximately $4.8 billion alongside partners. This includes 54 funds that have supported over 800 startups and small businesses across sectors like e-commerce, fintech, healthcare, and logistics.

SMPL AI’s Mohammad Abu Sheikh, and Qora71’s Youssef Salem

💼 Abu Dhabi-based Smpl Holdings’ venture fund, Smpl Fund I, has invested $250k in multiple AI and tech startups within Qora71’s portfolio. Launched in June, Smpl Fund I is a $10 million venture fund focused on providing seed capital and strategic support to early-stage AI and tech startups. Qora71, a venture investor syndicate and part of the Hub71 Angel Program, offers accredited investors flexible investment opportunities in high-growth tech firms. Its portfolio includes over 50 AI and emerging technology companies, with recent investments in Basetwo AI, zypl.ai, Abwab.ai, autone, Biosapien, and Algooru.

💰 Amkan Ventures, a Dubai-based fund-of-funds backing emerging venture investors, has made its fourth investment in Levante Capital, led by Yousif Al-Dujaili, formerly of Hummingbird Ventures. Levante focuses on early-stage startups with a high-conviction investment strategy, often allocating a significant portion of the fund to each portfolio company. Amkan, led by Raida Daouk, bridges family offices in the Gulf region with emerging U.S.-based VCs—two groups that rarely intersect. In April 2024, Amkan announced it had raised $5 million toward its $10 million target for its debut fund.

💸 Fintech

💰 Saudi-based Forus, a P2P lending platform for SMEs, has secured a $60 million credit facility from Fasanara Capital. Founded in 2019 by Nosaibah Alrajhi, Forus has provided over $390 million in working capital to more than 400 Saudi SMEs. This new funding is expected to allow Forus to offer over $150 million in working capital loans, supporting the growth of hundreds of Saudi SME borrowers and aligning with Saudi Vision 2030's goals to boost SME contributions to the GDP.

🏠 Keyper has partnered with First Abu Dhabi Bank (FAB), Dubai First, and Mastercard to make the Rent Now, Pay Later (RNPL) program available to their users in the UAE. Tenants can pay rent in monthly instalments using their FAB or Dubai First Mastercard credit cards, with benefits including AED 500 cashback and a chance to win back a month’s rent (up to AED 100,000).

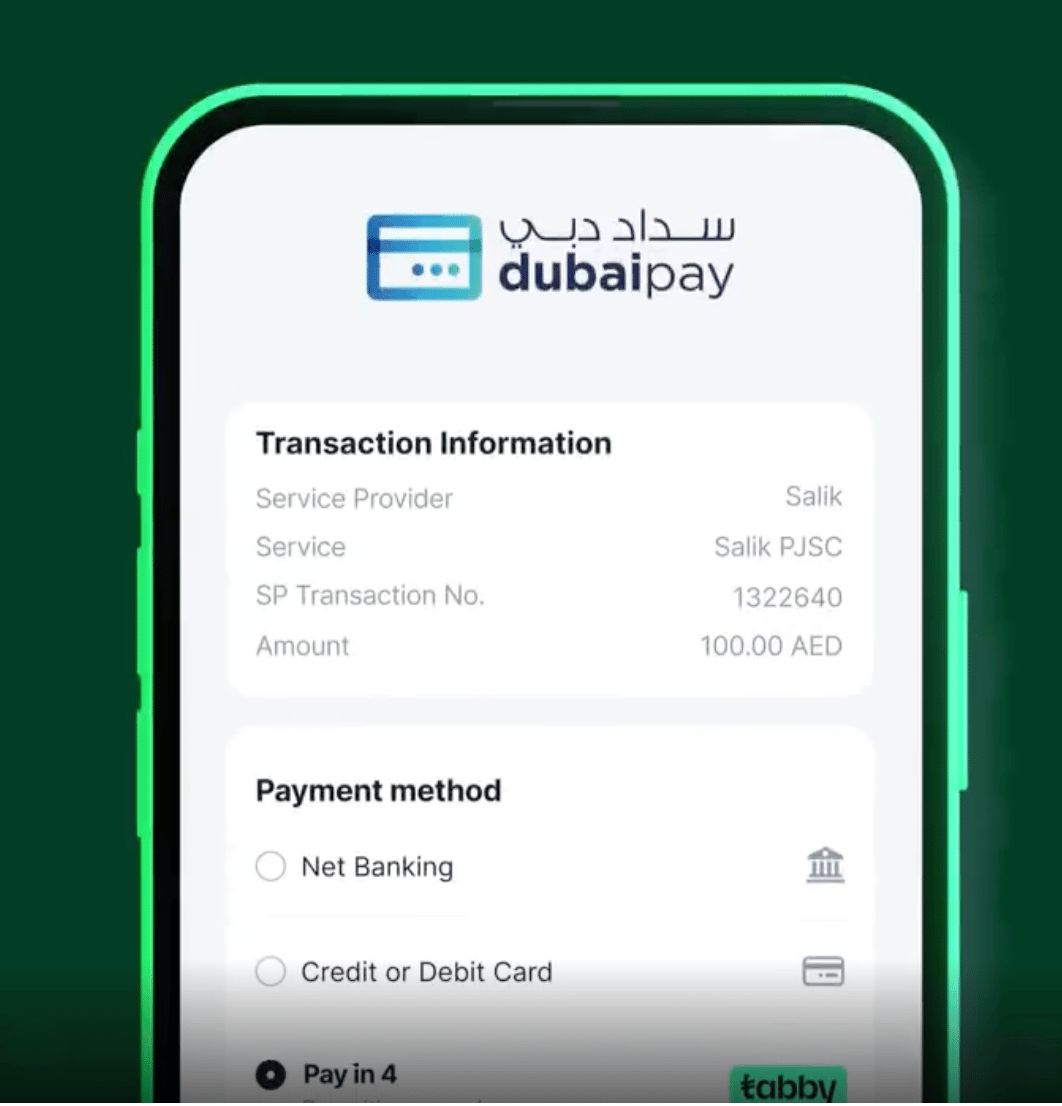

🚀 Tabby now offers flexible payment options for Dubai government services, partnering with 60+ entities and 200+ services, including RTA, Dubai Police, and Salik –the first BNPL provider to do so.

🌍 Careem Pay has revamped its international transfer services by eliminating fixed fees and introducing exclusive rates for Careem Plus members. This initiative claims to make it more economical to send money abroad, particularly to regions like India, Pakistan, the Philippines, the UK, Europe, and Lebanon.

🤝 Acquisitions

🇸🇦 SiFi has acquired Neya Technologies, a Dubai-based business expense management platform, to enhance financial services for over 500 Saudi companies. This acquisition, which includes securing a license from the Saudi Central Bank, integrates key Neya leaders like Rami Panayoti and Mohammed AlMughrabi into SiFi's team. The deal positions SiFi as the first licensed fintech to manage government expenses in partnership with the Saudi Ministry of Finance, introducing Apple Pay and expanding local transfer capabilities.

🤖 AI

🚀 You may have seen this little logo at the bottom of your WhatsaApp messages this week – Meta AI has officially launched across MENA, now available in UAE, Saudi Arabia, Egypt, Morocco, and Iraq, with more countries to follow. The AI assistant is free across Facebook, Instagram, WhatsApp, and Messenger, supports Arabic, and requires no registration. Features include real-time image generation and image animation directly within the apps.

🌐 OpenAI CEO Sam Altman is visiting Abu Dhabi this week to discuss potential funding from UAE-based MGX as part of his $40 billion fundraising tour in Asia. The funds aim to enhance ChatGPT and support AI infrastructure projects like Stargate. This follows OpenAI's $6.6 billion funding round in October 2024, which included MGX and valued the company at $157 billion. Founded by Mubadala and G42 in March 2024, MGX focuses on AI infrastructure, semiconductors, and data centers, recently backing a $30 billion initiative in the sector.

🗓️ Opportunities

📢 Applications are open for Sanabil Angel Investing Unlocked by 500 Global (2025 Cohort). This three-day program in Riyadh (April 22-24, 2025) covers deal sourcing, due diligence, and portfolio management, led by 500 Global and industry experts. Designed for emerging angel investors. Find out more and apply here!

📢 RAK DAO launches Builder’s Oasis Accelerator. Ras Al Khaimah Digital Asset Oasis (RAK DAO) has launched Builder’s Oasis, a $2 million accelerator in partnership with XDC Network, supporting Web3, gaming, AI, and blockchain startups. The 8-week program offers up to $100,000 in funding, mentorship, fast licensing, and market guidance. Applications close end of February 2025. Apply here.

🎧 In this week's episode of the VC React Podcast, we explored 500 Global’s new MENA fund, BioSapien’s $7M pre-Series A, and Silkhaus’ Saudi expansion. We also discussed DeepSeek AI’s breakthrough and its ramifications for other emerging tech ecosystems, as well as Silicon Valley.

Get seen. Advertise with FWDstart.

Elevate your brand and expand your reach with FWDstart – your trusted source for insights into MENA tech and VC.

Reach top founders, investors, LPs, operators, and technologists shaping and engaging with the region.

Advertise with FWDstart and make an impact. Get in touch here.

👋 Message from the team

Thanks for reading this week’s edition!

Have a question or any feedback? Just hit reply, or provide a rating below - we want to hear from you!