Happy Friday! We don’t know about you, but we are very much looking forward to the weekend…

But before we get there, let us give you the lowdown on Wa’ed Ventures' second AI investment in as many weeks, Egypt’s fintech unicorn securing funds to expand, and why e-commerce is still ripe for investment.

P.S. If you missed our weekly Wednesday deep-dive, we looked at the companies, countries and LLMs bridging the gap between the Arab-speaking world and advancements in AI, you can check it out here.

Today’s briefing is a 5 min read:

📦 Saudi logistics platform OTO secures $8m funding to fuel UAE and Turkiye expansion

🇸🇦 Saudi’s Wa’ed Ventures makes $15 million solo investment in South Korean chipmaker Rebellions

💳 Egyptian unicorn MNT-Halan secures $157.5M to drive expansion

🚀 Weekly funding round-up

MNT-Halan (🇪🇬 Egypt), a microfinance and payment fintech unicorn striving to bank to bank the unbanked, has secured $157.5 million in funding led by the International Finance Corporation (IFC) with a $40 million investment, alongside existing investors like Development Partners International (DPI) and Lorax Capital Partners, to drive expansion.

Pathfinder (🇦🇪 UAE), a retail tech solutions provider, has raised $325 million from Silver Rock Group via an equity line of credit. The funding will support the global rollout of its Gen AI-powered RetailGPT platform and coincides with its upcoming NASDAQ listing in Q4 2024.

Mamo (🇦🇪 UAE), a fintech that helps SMEs consolidate their payment collection, corporate cards and expense management needs, has raised a $3.4 million funding round provided by existing investor 4DX Ventures and the Dubai Future District Fund, along with Cyfr Capital.

Techmal (🇸🇦 KSA), a fintech offering financing solutions to convert annual or semi-annual rent into monthly instalments, has raised $1 million in a pre-Seed investment round, led by Al Majidiya Investment Company alongside other investors.

Kemitt (🇪🇬 Egypt), a marketplace that connects product and furniture designers with consumers, handling the manufacturing, overheads, and last-mile logistics, has raised an undisclosed funding round to fuel its expansion to Saudi Arabia.

Intercom for Startups

Join Intercom’s Early Stage Program to receive a 90% discount.

Get a direct line to your customers. Try the only complete AI-first customer service solution.

Logistics

📦 Saudi-based logistics startup OTO has raised an $8 million Series A round, for its shipping gateway that enables online merchants to manage, ship, track, and analyse their shipping and storage activities, from one platform.

The startup connects online store owners with over 250 local and international shipping companies and e-commerce platforms, automating every aspect of the shipping process.

💰 Investor lowdown: The round was led by PIF-owned Sanabil Investments, who were also joined by Saudi’s Sadu Capital, UAE’s Iliad Partners, Jordan’s Propeller, and US-based Soma Capital.

🏄♂️ Streamline it

Online store owners typically have to manage and ship their orders using different providers, which generally means using multiple dashboards. OTO streamlines this process by allowing merchants to ship, manage, and track their orders from a single platform.

OTO offers integrations with various e-commerce and logistics platforms, including Shopify, FedEx, and DHL, among others.

Merchants can connect their own shipping contracts to their Oto account or purchase them at discounted rates through its partnerships with 20 local and international shipping companies.

🐂 OTO bull case

OTO claims to serve over 10,000 local and international brands through its platform, having doubled its revenue year-over-year and experienced significant growth in orders processed.

The GCC and Turkish e-commerce markets are projected to exceed $150 billion by 2030.

🔮 Flashforward

The Saudi startup plans to use the funds to strengthen its presence in Saudi Arabia, UAE, and Turkey. It also aims to enhance its platform to help online merchants ship faster and offer a better shipping experience to their customers.

💰 VC round-up

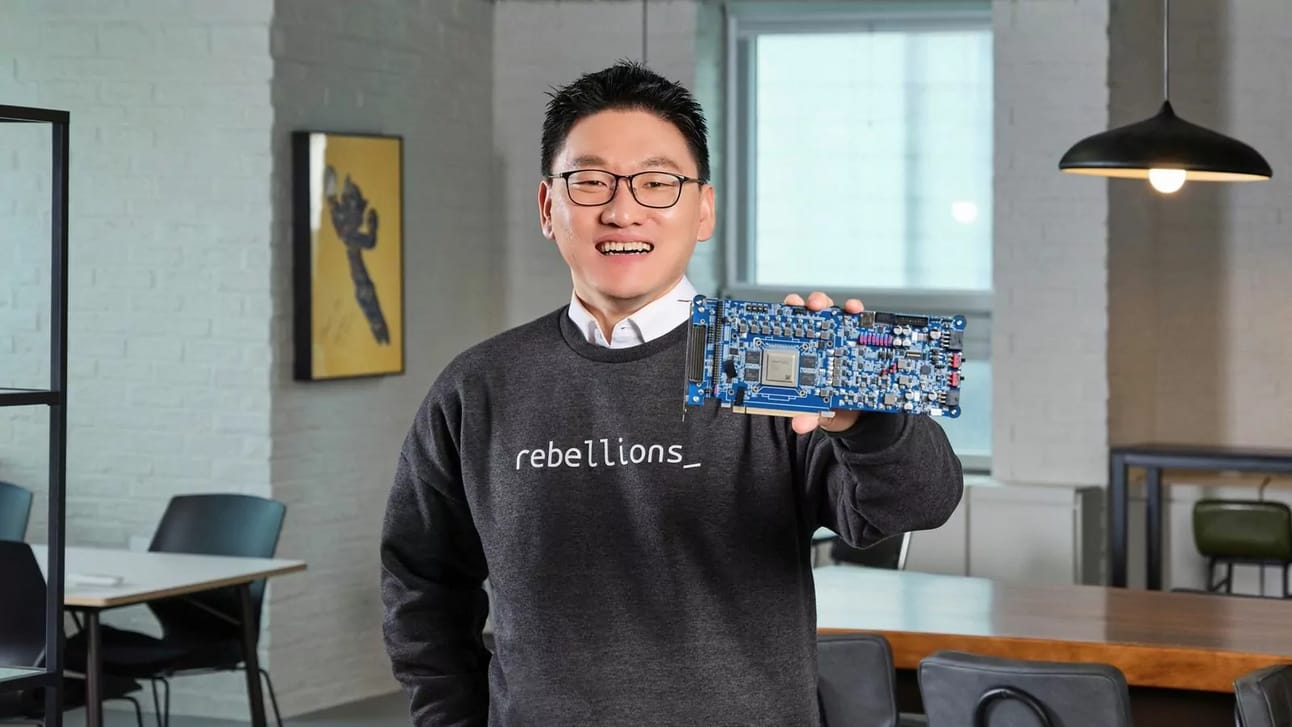

🇸🇦 Wa’ed Ventures, backed by aramco, has announced a $15 million solo investment in South Korean AI chipmaker Rebellions' Series B extension round. Specialising in AI inference chips, Rebellions is collaborating with Samsung on a proprietary chip for the GenAI market. As part of Wa’ed Ventures' first deal in South Korea, Rebellions will establish a Riyadh-based subsidiary. The startup has now secured over $225 million in total funding.

This marks Wa’ed Ventures' second investment in the AI sector in as many weeks, following a $6.5 million pre-Series A funding round for Californian AI no-code platform aiXplain.

🇦🇪 Shorooq Partners has led a $1.5 million pre-Series A round in Pakistan’s mobility startup Zyp Technologies, joined by Indus Valley Capital and several angel investors. Founded in 2022 by Hassan Khan and Imran Afzal, Zyp specialises in electric motorcycles for deliveries with advanced fleet management software.

🇯🇴 ISSF has increased its commitment to Jordan-based Oasis500's second fund, Oasis Ventures II (OVII), from $3 million to $5 million. According to CEO Luma Fawaz, this partnership has supported 36 startups (36% led by women) and created 300 direct and 1,000 indirect jobs. ISSF has invested in 17 funds in total, including MSA Novo’s MENA Fund, Propeller Ventures II, VentureSouq Fund II, and Global Ventures III this year.

🇮🇶 EQIQ has led a $500,000 pre-seed round for Finnish edtech Corrsy, founded in 2019 by Mustafa Salam to address educational challenges in Iraq and the Middle East through a gamified mobile app. The app has over 500,000 downloads in Iraq to date. This is EQIQ's second investment this year, following Wayl’s $150,000 pre-seed round in February.

💸 Acquisitions

💰 A group of undisclosed Saudi investors has acquired Arabic social media monitoring platform Crowd Analyzer. The company expanded to Saudi Arabia and Egypt in 2017, and later, in 2019, Crowd Analyzer raised over $3.5 million in Series A funding led by Tech Invest Com, with participation from Wamda Capital, Arzan VC, Faith Capital, and Daring Capital. The acquisition aims to help the company enter new markets and develop a broader range of data analysis and computational insights products beyond just social media monitoring.

📆 Events and opportunities

🌍 Viaka is hosting their second ViakaSessions event, featuring key figures in the Tunisian startup ecosystem:

Manar L. (Cynoia), Amin Ben Abderrahman (Konnect Networks), Salma Baghdadi (@The Wave Global), and Faten Aissi (Flat6Labs).

The panel will be moderated by Hossam Shafick (Silicon Badia).

💡 Learn about Tunisia's startup landscape, recent exits like Instadeep and Expensya, and the impactful "Startup Act" of 2018.

🇸🇦 500 Global is looking for the next generation of talented entrepreneurs in MENA join Batch 8 of the Sanabil 500 MENA Seed Accelerator Program.

Tech startups with a Minimum Viable Product (MVP)

Located in the Middle Eastern and North African Region (MENA)

Startups with early traction looking to scale

📰 What we’re reading

Khaled Talhouni. What makes for a great founder?

Tariq Bin Hendi, PhD and Marika Brivio. China and the Middle East: The new Silk Road is revitalising modern trade

Dunya Hassanein. How Saudi Arabia is Leading the EV Revolution Globally

👋 Message from the team

Thanks for reading this week’s edition!

If you’re enjoying the newsletter, don’t forget to share it with a friend!

Have a question or any feedback? Just hit reply, or provide a rating below - we want to hear from you!!

How was this newsletter edition?

Was this forwarded to you? Sign up here.